Posted Wednesday 30th June 2021

The construction sector makes up almost 10% of the EU’s GDP and tech innovators and entrepreneurs are eyeing to make changes in the sector. Despite this, technology only concerns a small percentage of the market. Is this the year that things begin to change?

Commercial property in the City of London is attracting investors despite the majority being empty in comparison to pre-lockdown levels. With prices more competitive now, investors are seeing the long-term possibilities.

The property sector has boomed since the Chancellor implemented a stamp duty tax break during the pandemic. Now it is beginning to come to an end, what impact is it likely to have on prices and purchase levels?

Good news for the high street… Mike Ashley’s Sports Direct has said it is looking for stores (lots and lots) as it begins to expand its brand into across the UK and Europe. This will be music to the ears of Landlords currently holding vacant commercial space on the high street!

It is estimated that retail and hospitality tenants have amassed £5bn in rental debt. This is set to continue as, following the extension of restrictions, it was announced that the moratorium on evictions of commercial tenants is being extended once again.

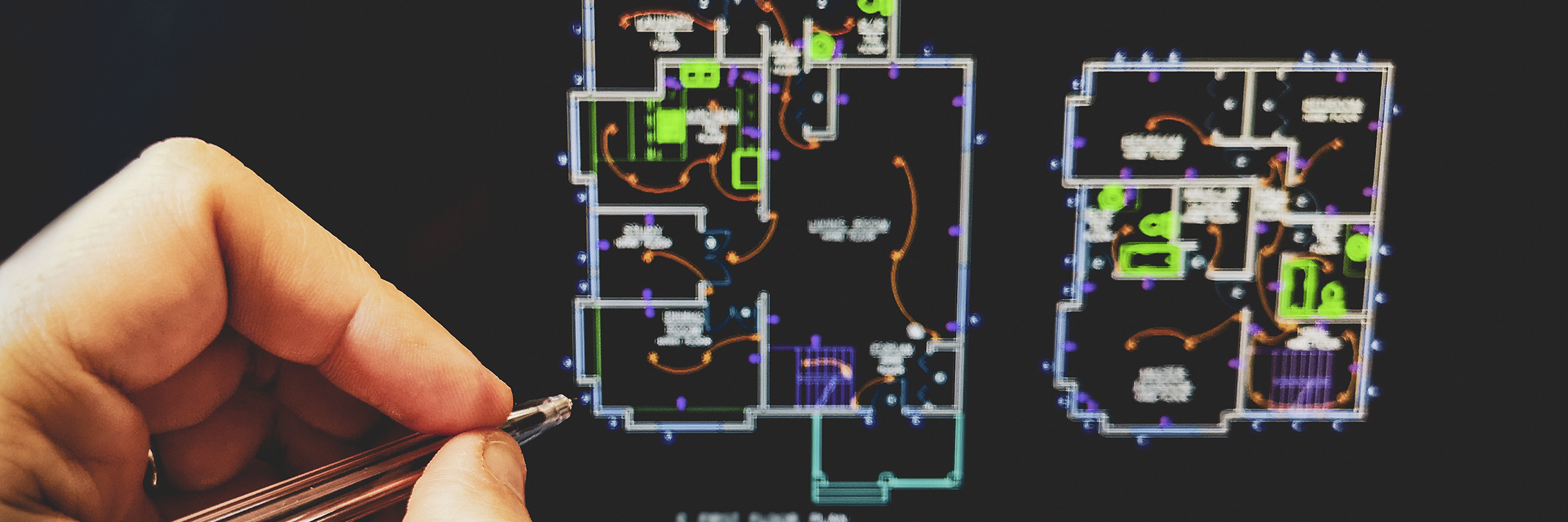

Modulous, a digital construction firm, has raised £5m from venture capitalists to grow its offering in the sector. The company uses a software platform to streamline design which combines with its own modular building system.

It’s been a tumultuous time for the commercial property sector, as well documented but does the future look more positive? What can landlords and businesses do to provide an attractive commercial property offering?

This article is for reference purposes only. It does not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking or deciding not to take any action.